2022: "Same same but different" or "deja vu all over again"?

Asia-Pacific Private Credit Newsletter

January 2022

We are in the business of trying to capture intrinsic value for investors via APAC SMEs requiring private credit solutions. Our investment process for doing so is primarily bottom-up - based on due diligence, fundamental analysis, and strong underwriting discipline.

But if recent years have taught us anything, it's that no business model operates in a microeconomic bubble. Changing macroeconomic, trade and social policies all contribute to the success or otherwise of a deal. The pandemic has accelerated what was already a rapid rate of change.

However, sitting in Hong Kong in January 2022, it feels weird writing about rapid change. Despite SARS‑CoV‑2’s clear ability to evolve and mutate, our city’s approach has remained steadfast to its original tenets of social distancing, school closures and wholesale curbs on the consumer service industry. To us, 2022 still feels a lot like 2020/21.

This sets the tone and the framework for the risks and opportunities we see as 2021 turns over to 2022. The themes we discussed last year - COVID, inflation, real rates, ESG and regulatory policy - remain key portfolio construction factors for private credit managers in APAC. Yet 2022 is not just “2020: Season Three”. We also see divergences emerging which we expect will define 2022. Perhaps the transition is best summed up by that staple phrase of SE Asian English, “same same but different.”

Theme 1: The recovery is now being led by the West, not the East

The latest projections from the IMF expect another strong year for global economic growth in 2022.

2022: "SAME BUT DIFFERENT" OR "DEJA VU ALL OVER AGAIN"?

In this Newsletter we discuss:

1. Thematic focus -Our key themes for APAC Private Credit in 2022

2. News centre - Links to articles and papers we found interesting

Source: Zerobridge Partners

In Asia, inflation is not at present an endogenous risk – for most companies we speak to, it’s a topic of conversation but not yet playing out in financial statements. However, Powell and others’ ability to get inflation under control ultimately impacts input costs, such as commodity prices and exchange rates, and we expect that inflation will become an important factor for APAC SMEs as 2022 progresses.

Geopolitics and nations’ COVID policies may also contribute. Oil, gas and other commodities prices are vulnerable to the standoff between the US/NATO and Russia over the Ukraine. In China, further Omicron-driven lockdowns present significant risks to the efficiency of global supply chains.

Inflation makes us think harder about the price elasticity of our target companies – are they price takers or price makers? In an environment where commodity prices are rising or remain elevated, related businesses are price makers and should make for attractive credits. Businesses which require specific commodity inputs will likely be more vulnerable to margin pressure. These are price takers and are relatively riskier credits in an inflationary environment.

APAC is a diverse region containing both major commodity exporters and importers. While the broader risks of the post-COVID landscape - supply chain disruption and high energy costs - are generally negative, there is sufficient opportunity to select deals which offer stronger outcomes against the backdrop of higher commodity prices.

Commodity prices also tend to be negatively correlated to US dollar strength and investors should watch this closely. If the Fed fails to get on top of inflation (a growing concern voiced here) a weaker US dollar may be good for APAC businesses, as it translates into cheaper commodity prices in local currencies (as well as potentially stronger profits for commodity-related businesses). A weaker dollar also makes hard currency debt easier to pay back. A strong reaction from the Fed in the form of unexpected rate hikes would create the opposite effects.

Our goal here is not to forecast but rather to consider how the risks might play out. Ideally, we’d would prefer to take the Fed at its word and see a gradualist path on tightening. A manageably weaker dollar in 2022 may also persuade global allocators to invest more in higher returning markets such as APAC.

Theme 3: The search for real yield continues

As we said in our November newsletter, the progress of US monetary policy offers US fixed income investors a choice of unpleasant scenarios. If the Fed and other central banks don’t do enough to dampen inflation – and most are constrained by the size of their own balance sheets - real yields will continue to get crushed. Exhibit 4 is a reminder of the value of negative-yielding bonds outstanding.

If the Fed responds more aggressively than anticipated, the result will be capital losses for bonds, especially those with lower coupons and/or longer tenors. These risks make large swathes of the public bond market uninvestable in pure return terms and debt investors seeking real returns will need to look to private market solutions. Nothing has really changed in this story since November.

But one segment offering real yields is markedly different to 2021. Last February we discussed the relative attractions and risks of the US dollar Asian high yield market which at the time was yielding around 7%, with low implied default rates and strong investor interest. Since September this market has been mostly off limits to all but the most highly specialised investors, due to distress in its biggest issuer constituency, the Chinese property market.

Within less than a year, one of the key sources of Chinese economic growth, household wealth and tax revenue looks like it will come under state control. And most of an asset class that was being sold as an income play to retail investors and retirement savings accounts is now the target for distressed debt funds. That represents a significant change for Asian credit markets as we enter 2022.

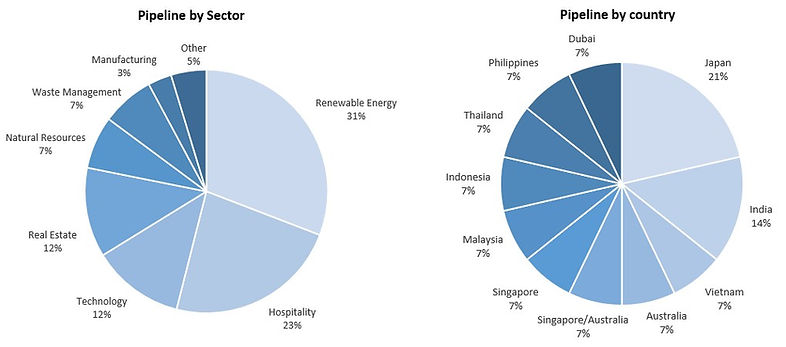

When it comes to extracting real value from credit, we maintain the same stance as always. Credit is an asset class with a negatively skewed payoff profile. The keys to success are to maintain a disciplined credit underwriting focus to assess risk, aligned with careful structuring and strong covenants. APAC private credit holds up well under this philosophy and, thanks to the relative lack of integration between local markets, the borrower base is not integrated with the high yield market as can be seen from our pipeline in Exhibit 5.

Source: Bloomberg Barclays Global Aggregate Negative Yielding Debt Index: Corporates,

29 January 2010 to 9 November 2021, Bloomberg

But economic rebounds after sharp shocks can produce diverse outcomes, based on policy differences. China and other Asian industrial economies led the pandemic recovery in the early stages as the West remained locked down. Two years later, that dynamic has reversed – the West has re-opened borders and wallets while Asia remains constrained by the pursuit of “zero-COVID” in China and Hong Kong, even as regional peers such as Singapore start to frame the virus as endemic. With a reversal of zero COVID unlikely, constraining activity as a result, we expect the growth differential to narrow substantially between the US and China this year.

Does this new dynamic impact prospects for APAC private credit? Despite the superior risk-adjusted returns in APAC, there is a risk that North American and European allocators remain focused on their home markets, supported by the narrowing growth differential.

For allocators with longer time horizons, however, we believe 2022 may be a good time to explore APAC as the post-pandemic ushers more private credit solutions into the market. The likelihood of further bank retrenchment, especially Chinese lenders, from the SME market increases the demand for private credit, especially in the Opportunistic space. As we saw in 2021, while societally unpleasant, lockdowns and social distancing policies can be instruments of creative destruction and opportunistic deals. We also expect 2022 to be the year when tourism returns to ASEAN. Even if the return of Chinese tourists is required for full capacity, we expect ASEAN resorts to begin to safely attract other nationalities back to the resorts. Well-managed businesses in the tourism sector should see positive earnings impact from operational leverage as customers return.

Theme 2: Inflation is persistent but can it be tamed?

Inflation was a topic of debate in H2 of 2021 and it still is now. But the nature of the debate has changed. “Transitory” inflation is no longer a thing. At 7% for December, US CPI is high, broad-based, and likely to persist. The debate now shifts to whether the Fed’s 2022 strategy of moderate rate rises, and gradual tapering of bond purchases will be sufficient to bring inflation back towards the long-term target.

Exhibit 4: Total Value of Negative-yielding bonds

Exhibit 1: Latest World Economic Outlook Growth Projections (real GDP, annual percent change)

Source: IMF, World Economic Outlook, October 2021.

In our view the global growth environment still provides a constructive backdrop for risky assets. Although monetary policy is expected to tighten, the amount of fiscal and central bank stimulus thrown at the system since early 2020 should continue to support risk-taking, as captured in Exhibit 2.

Exhibit 3: The Fed’s new “dot plot” and tapering schedule

Source: Goldman Sachs, Bloomberg, as of 14 January 2022.

Source: Bloomberg, based on the Federal Reserve meetings held 16 June 2021, 22 September 2021 and 15 December 2021.

Exhibit 5: Pipeline

Source: Zerobridge Partners as of 14 January 2022.

Theme 4: Policy - ESG and Common Prosperity

ESG considerations represent an enormous opportunity for many asset classes including APAC private credit, as the Renewables weighting in the Exhibit shows. We also believe that “traditional energy” businesses could continue to perform well in the medium term. Around 4/5 of global energy still comes from these sources - that proportion is higher still in Asia and emerging economies. A recent export ban on thermal coal by Indonesia, showed how sensitive many APAC countries are to the supply of fossil fuels.

ZEROBRIDGE PARTNERS

Zerobridge Partners Asset Management Limited is focused on giving institutional & high net worth investors globally access to APAC alternative credit opportunities. The strategy seeks to take advantage of the less developed banking and capital markets in the APAC region and capitalize on our strong proprietary deal flow.

Zerobridge Partners Advisory Limited is a debt advisory firm focusing on raising new capital, creditor negotiations and debt restructuring for companies in Asia-Pacific. We come with deep investment banking experience and a strong track record across multiple credit cycles in Asia.

NEWS CENTRE

APAC bank lending retrenchment continues

Chinese banks cut back traditional lending concern over economy mounts |FT

Can US inflation be tamed?

Henry Kaufman, 1970s Wall Street Dr. Doom, Blasts Powell on Inflation |Bloomberg

Thailand Test & Go

Thailand to Resume Quarantine-Free Tourism as Covid Eases | Bloomberg

De-risking China’s property sector

Xi Reshapes China Property Market Paving Way for State Dominance |Bloomberg

Indonesia: Coals to Balikpapan

Indonesia’s Coal Ban Remains Even as Dozens of Ships Depart | Bloomberg

ESG in Asia (from DSG Asia)

ESG criteria are distorting markets and portfolio decisions (Ogus) | OMFIF

Chinese domestic policy

Changing China: How Xi's 'common prosperity' may impact the world | BBC News

If you have an article on Private Credit that you think is interesting, please send it to us at enquiries@zerobridge.com

LEGAL DISCLAIMER

Zerobridge Partners Asset Management Limited and Zerobridge Partners Advisory Limited (together “Zerobridge”) have prepared this Newsletter (the “Newsletter”) for the exclusive use of the recipient. The Newsletter is proprietary to Zerobridge and is intended solely for the information of the person to whom it has been delivered. By accepting delivery of the Newsletter, the recipient agrees not to reproduce or distribute the Newsletter in whole or in part and not to disclose any of its contents to any other person except as agreed in writing by Zerobridge.

The Newsletter is for informational and discussion purposes only and does not constitute a solicitation or an offer to buy or sell any securities. Any offering of securities will only be made pursuant to a private placement memorandum and definitive subscription documents (the “Definitive Documents”), which will be furnished to qualified investors at their request in connection with any such offering. The information contained in the Presentation is qualified by reference to the Definitive Documents, which will entirely supersede the Newsletter.

The investment contemplated by the Newsletter will involve significant risks, including the potential for loss of the entire amount invested. Any securities offered will not be registered under U.S. or other securities laws and may not be transferred or resold except under certain extremely limited circumstances. Prospective investors should pay particular attention to the risk factors to be appended to the Definitive Documents and should have the financial ability and willingness to accept the risk characteristics of the proposed investment, and to bear those risks for an indefinite period of time.

The Newsletter has not been submitted to, reviewed or approved by any regulatory authority in the U.S., Hong Kong, Cayman Islands or elsewhere. Further, the Newsletter does not constitute financial, legal, tax, investment or other advice or a recommendation to make an investment. Accordingly, recipients may not rely on the Newsletter for any purpose and instead must rely solely on their own judgment, analysis and review in evaluating an investment, and should obtain independent professional advice with respect thereto.

Although the Newsletter has been compiled from sources which Zerobridge believes to be reliable, Zerobridge has not independently verified the Newsletter and expressly disclaims any liability for the accuracy, completeness or reliability of the Newsletter, for updating the Newsletter, or otherwise in connection therewith. The performance data contained herein is not indicative of future results, and there can be no assurance that comparable results to past performance will be achieved, or that performance targets will be met.

Certain information contained in the Newsletter constitutes “forward-looking statements”. The actual performance of the investment contemplated by the Newsletter may differ materially from the projected performance reflected or contemplated in such forward-looking statements. Prospective investors should not rely on such forward-looking statements in deciding whether to make an investment.

The Newsletter is only intended for and will only be distributed to persons resident in jurisdictions in which such distribution is permitted by applicable law. Any investment contemplated by the Newsletter may not be eligible for sale in some jurisdictions. Specifically, Zerobridge is not authorized under the Alternative Investment Fund Managers Directive (“AIFMD”) and no notification has been made to any regulator in the European Economic Area (“EEA”) in respect of any proposed investment opportunity. As a consequence, no securities are being actively marketed by Zerobridge to any investor in the EEA.

The information contained in the Newsletter should be treated in a confidential manner and any reproduction or distribution thereof, in whole or in part, or the disclosure of any contents therein without the prior written consent of Zerobridge is strictly prohibited.

Exhibit 6: The Emerging Economy Opportunity for Power Generation Is 5x That of Advanced Economies

Source: KKR. Note: The Stated Policies Scenario (STEPS) takes account only of specific policies that are in place or have been announced by governments. Data as of May 2021. Source: International Energy Agency (2021), Net Zero by 2050, IEA, Paris: Net Zero by 2050 Scenario - Data product - IEA. License: Creative Commons Attribution CC BY-NC-SA 3.0 IGO.

For APAC businesses exposed to traditional fossil fuels, as said in March, we believe it is better for investors to realise value through bottom-up engagement rather than top-down divestment. Private debt can have a large part to play in this engagement process as the extent of lender influence is stronger compared to what is seen in other regions. Not only does this help us in our fiduciary goal of getting our clients’ money back but it also has positive implications for influencing borrowers’ adherence to ESG factors.

Some commentators identify a possible element of geopolitics in Western governments’ focus on ESG policy. Whether this is the case, the transition highlights China’s resolve to forge its own unique development path. Energy policy is just one example of a desire for greater self-reliance.

Exhibit 7: China’s Energy Policy Mix, 2015-2070

Source: KKR. Data as of October 12, 2020. Source: Tsinghua University report.

China's domestic focus on common prosperity echoes certain aspects of Western ESG (greater corporate responsibility, improved social mobility) as well as a unique focus on moral rectitude which perhaps reflect the personality of the ultimate author. This creates additional uncertainty for some established business models within Greater China, and for foreign businesses which have staked their strategy on Mainland customers, such as gaming and luxury goods. For these borrowers, we expect the concern in 2022 will be less about ESG and more about "ESXi" as this keynote policy evolves ahead of the 20th Communist Party National Congress in the autumn.

Exhibit 2: Goldman Sachs Financial Conditions Index